DEVELOPMENT TOPICS: Entrepreneur and small business support

Small businesses are often said to be the backbone of economies, driving job creation and growth. Small and medium-sized enterprises (SMEs) provide around 80% of jobs across the African continent.

According to the Centre for Strategic & International Studies, sub-Saharan Africa’s tens of millions of SMEs are primarily micro-sized and informal. Yet it is these small businesses that help to lift citizens out of poverty and drive a more inclusive and mature economy. At the same time, the small business sector faces many challenges, including limited access to finance or markets, low economic growth, bureaucracy, uneven cash flow, a dearth of skilled staff, red tape and complex regulations, among others. Fundamentally less resilient than larger organisations, small businesses are at greater risk of failure.

Company support for entrepreneur and small business development

Investing in small businesses stimulates their growth and draws them into the broader economy, often through supply chains.

There are a number of ways in which big businesses can assist smaller ones, including providing access to markets, providing funding, accelerating business development through training and mentorship and helping companies promote their goods and services.

National context

- The Department of Small Business Development (DSBD) was allocated R2.9 billion for 2025/26, constituting 0.1 % of consolidated government expenditure of R2.59 trillion for the financial year. Transfers and subsidies accounted for 84% of this, with most (R1.9 billion) going to the Small Enterprise Development Finance Agency (SEDFA), which was established by the National Small Enterprise Amendment Act in October 2024 and merges several previous agencies.

- The National Development Plan states that 11 million jobs need to be created between 2012 and 2030, with small enterprises or start-ups expected to create 90% of these new jobs.

- The FinScope MSME Survey South Africa 2024 estimates that there are approximately three million small, micro and medium enterprises (SMMEs) in South Africa, employing around 13.4 million people. DSBD data indicates that 38% of SMMEs operate in the trade and accommodation sector, followed by 15% in construction services, 15% in community services, and 14% in finance and business.

- The 2024 edition of The State of the SMME in South Africa, produced by the Shoprite Group, reports that women own just over half (51%) of all microenterprises, which employ between one and five people. However, the level of women’s ownership declines as SMMEs grow. Women own only 13% of medium-sized businesses, which employ 51–200 people. (For more information, read The State of the SMME in South Africa report on page 231.)

- The DSBD’s Medium Term Development Plan, which runs from 2024 to 2029, aims to support one million SMMEs, while creating 273 500 jobs and sustaining 1.6 million jobs over the period.

- In April 2025, the DSBD, in partnership with the Department of Trade, Industry and Competition, launched a R500 million fund to support spaza shops. The fund aims to enhance market competitiveness and help spaza shops and food outlets compete with larger retailers.

- During his 2025 State of the Nation Address, President Cyril Ramaphosa announced the establishment of a Transformation Fund worth R20 billion a year, over five years, to fund black-owned and small business enterprises. It aims to improve the effectiveness of broad-based black economic empowerment (see page 157 for more on the proposed transformation fund).

- South Africa was ranked 49th out of 56 economies in the Global Entrepreneurship Monitor’s (GEM) National Entrepreneurial Context Index for 2024/2025. The index measures the average state and quality of the country’s entrepreneurial ecosystem. Only one of the GEM’s 13 Entrepreneurial Framework Conditions was rated as sufficient for South Africa. The country also scored equal to or below the group average on all 13 conditions in the 2024/2025 report.

Overview of CSI spend

Half of companies contributed towards entrepreneur and small business support, investing 5% of average CSI expenditure.

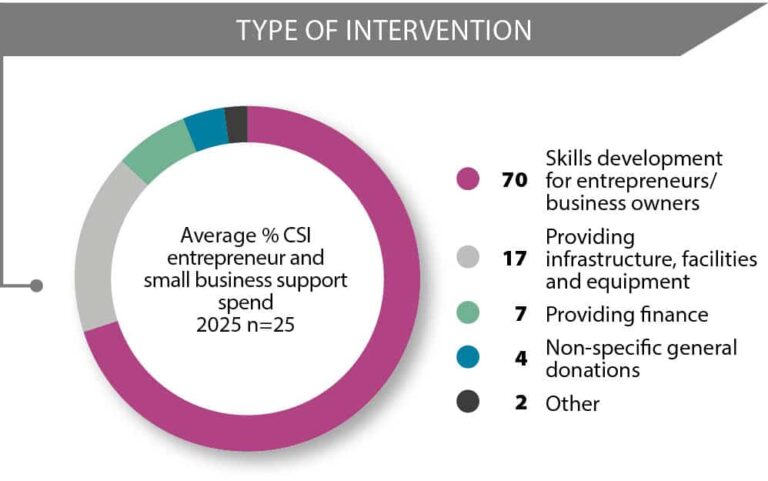

- The majority of CSI expenditure in this sector (70%) went towards skills development for entrepreneurs and business owners, a significant increase from 57% in 2024.

- The second-largest expenditure area in this sector was providing infrastructure, facilities and equipment, which received 17% of funds on average, a slight decrease from 20% in 2024.

- Only 7% of average sector CSI spend went to providing finance, down from 15% in 2024.

- Only a fifth of companies (21%) reported that the entrepreneurs and small businesses supported through their CSI initiatives also form part of company value chains, notably down from 52% in 2022.

- Other support mentioned in this sector included mentoring, guidance and advice.